Buy Verified Wise Accounts

Wanna to buy verified wise accounts, from the right places at affordable expenses? The Azovcc.Com group presents USA, UK, CANADA, AUS, KHM, COL, DEU, ASIAN, and, other nations Transfer Wise Accounts with less costly costs. Here you can purchase smart private and commercial enterprise money owed with an alternative assurance.

What is a confirmed sensible account?

A tested Wise account is an account that has undergone a verification manner to affirm the identification of the account holder. This manner is essential to ensure the safety and integrity of the Wise platform and to comply with regulatory requirements. When you have a demonstrated Wise account, you gain entry to extra capabilities and blessings that are not to be had by unverified users. These consist of better transaction limits, the capacity to preserve and manipulate more than one currency, and superior security measures to guard your price range.

Types of wise bills?

- Personal

- Business

- Personal Account:

- This sort of account is designed for individuals who need to ship and get hold of cash internationally.

- Users can preserve and manage a couple of currencies of their Wise account, making it convenient for global transactions and currency trading.

- Wise regularly affords a without-borders account function for personal money owed, allowing customers to receive cash in different currencies and convert it at the real change rate.

- Business Account:

- The enterprise account is customized for organizations and groups.

- It lets companies ship and receive cash globally, regularly with lower fees in comparison to traditional banks.

- Business debts might also have extra capabilities catering to the wishes of businesses, including multiple consumer get entry to, integration with accounting software, and the capability to keep and manage diverse currencies.

Personal or enterprise, what’s the quality?

Keep in thoughts that the precise functions and offerings of Wise bills may be situation to updates and modifications. For the most correct and cutting-edge information, I advise checking the professional Wise website or contacting Wise customer service immediately. Whatever, you want to shop for confirmed sensible money owed, you can try buyverifiedwise.Com. Buyverifiedwise is a passionate and enjoyable crew to affirm smart bills.

Whether a personal or enterprise Wise account is the satisfactory choice (to shop for established TransferWise Accounts) relies upon in your specific needs and instances. Here are some considerations for every sort of account:

- Personal Account:

- Ideal for people who in general want to send or acquire money the world over for non-public reasons.

- Good for travelers or human beings who have monetary transactions in a couple of currencies.

- Offers capabilities like a without-boundary lines account, which permits you to maintain and manage money in one-of-a-kind currencies.

2. Business Account:

- Geared towards agencies and groups that interact in worldwide transactions.

- May offer extra features like multi-consumer get right of entry to, integration with the accounting software programs, and tools designed to meet commercial enterprise economic needs.

- Can be appropriate for freelancers, small groups, or large establishments with international operations.

To decide which sort is first-rate for you, consider elements consisting of the character of your transactions, the frequency of worldwide transfers, and any unique capabilities or tools that align with your requirements. If you have a business or enterprise, a commercial enterprise account may be greater appropriate because of the tailor-made functions and functionalities.

If you want to shop for validated clever bills (Personal/Business) with complete documents, we’re a reputed No.01 website for purchasing validated TransferWise Accounts. Feel unfastened to order from us and get a hundred actual tested warmed-up money owed.

Which one is fine for plenty of transactions?

If you expect to conduct a high volume of transactions, whether they may be private or enterprise-associated, each private and commercial enterprise Wise bills can accommodate an extensive range of transactions. However, the form of account that’s excellent for you depends on the character of these transactions.

- Personal Account for Lots of Transactions:

- A personal Wise account with a boundaries function can be beneficial if you are coping with transactions in more than one currency. It permits you to keep and manage cash in distinct currencies and convert it at the real change charge.

- If your high quantity of transactions is broadly speaking associated with private budget, tour, or normal worldwide cash transfers, a private account can be appropriate.

- Business Account for Lots of Transactions:

- An Enterprise Wise account can be more suitable if the transactions are related to business activities, together with receiving bills from customers, making international purchases, or handling finances in your enterprise.

- Business bills regularly include additional functions like multi-user entry, integration with accounting software, and equipment designed to streamline business-associated transactions.

Benefits of Transfer Wise Accounts

It’s crucial to consider the particular functions provided with the aid of both types of accounts and how nicely they align with the character of your transactions. Additionally, don’t forget the costs related to each account kind, as excessive transaction volumes may additionally impact your basic prices.

For the most accurate and up-to-date statistics, overview the capabilities and fee structures on the reputable Wise internet site or touch Wise customer service. They can offer guidance primarily based on your precise needs and situations.

Wise, formerly known as TransferWise, offers numerous benefits that differentiate it from conventional banks and other money transfer services. Here are a few key benefits of using Wise accounts:

- Low-Cost International Transfers:

- Wise is known for supplying transparent and coffee-value worldwide cash transfers. The organization makes use of actual alternate quotes with only a small, advance fee, which can be extra cost-effective compared to traditional banks.

- Transparent Fees:

- Wise provides clean and transparent records about its charges, consisting of the change price and any applicable prices. Users can see the full value of the transfer upfront.

- Borderless Account for Personal and Business:

- Wise offers a without-boundary lines account for each non-public and commercial enterprise user, permitting them to maintain and manipulate cash in a couple of currencies. This can be useful for individuals and agencies with worldwide financial sports.

- Real Exchange Rates:

- Wise uses the actual mid-market change charge for foreign money conversion, which is frequently more favorable than the prices offered with the aid of traditional banks. This transparency ensures that customers get a fair deal without hidden markups.

- Fast Transfers:

- Wise is understood for its brief and green cash transfer services. Many transfers are completed within a few hours, especially for not unusual forex routes.

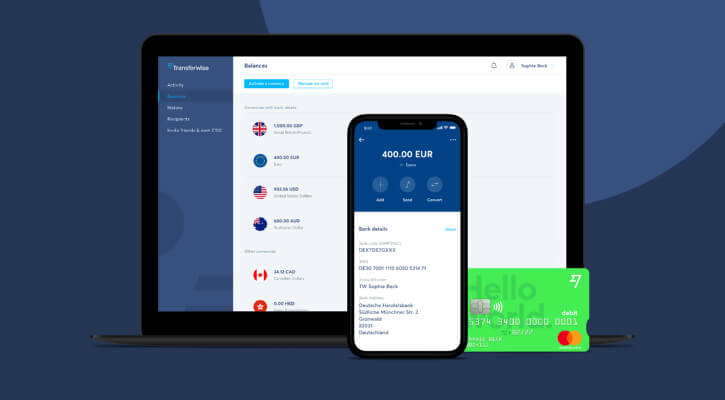

- Multi-Currency Debit Card (Wise Card):

- Wise offers a multi-foreign money debit card that allows customers to spend cash in more than one currency without incurring high overseas transaction expenses.

- Business-Friendly Features:

- For business users, Wise provides features like multi-consumer entry, integration with accounting software, and equipment tailor-made to fulfill the monetary needs of corporations engaged in international transactions.

- Regulatory Compliance and Security:

- Wise is a regulated economic group, that adheres to financial guidelines in diverse jurisdictions. This offers customers a level of acceptance as true and protection in their financial transactions.

It’s important to notice that the precise benefits might also vary based totally on the sort of account (non-public or commercial enterprise) and the person’s desires. As with any monetary service, it’s encouraged to test the contemporary features, phrases, and conditions on the legit Wise website and examine them with different options to decide the first-rate match for your requirements.

How do I verify smart accounts?

The method for verifying a Wise account may additionally contain the subsequent steps. Keep in thoughts that the information can also be modified, and it’s continually best to consult the maximum up-to-date facts at the respectable Wise website or contact Wise customer support for trendy instructions.

If you haven’t confirmed clever accounts but for transactions, you can buy confirmed smart money owed from us. We are providing completely readymade TransferWise accounts to get bills from worldwide.

Here’s a fashionable manual:

Personal Wise Account Verification:

- Create an Account:

- Start by signing up for a Wise account at the Wise internet site or via the mobile app.

- Provide Personal Information:

- During the account advent process, you’ll be required to provide private statistics consisting of your call, address, date of beginning, and different applicable information.

- Verify Identity:

- Wise may additionally require additional identity verification steps. This often involves uploading files consisting of a central authority-issued ID (passport, motive force’s license) and, in a few instances, evidence of address.

- Complete Verification Process:

- Follow the activities at the Wise platform to finish the verification system. This may additionally involve filing files and data via the net interface.

Business Wise Account Verification:

- Create a Business Account:

- Sign up for a Wise commercial enterprise account and offer essential information approximately your enterprise.

- Provide Business Documents:

- Business bills usually require extra documentation, inclusive of business registration files, tax identity numbers, and likely proof of coping with the commercial enterprise.

- Verify Business Identity:

- Wise might also request verification of the identity of people related to the enterprise, together with administrators or owners. This should contain filing non-public identity documents.

- Complete Verification:

- Follow the instructions furnished by Wise to finish the verification system for your commercial enterprise account.

Tips for Smooth Verification:

- Ensure that all files submitted are clear, valid, and healthy the facts supplied at some point of the account advent method.

- Double-take a look at the particular requirements of your United States and account type, as they’ll vary.

Always talk with the legitimate Wise website or touch Wise customer service in case you come upon any troubles or want help at some point with the verification technique. They can offer the maximum accurate and modern information tailor-made to your state of affairs.

Buy Verified TransferWise bills With Full Documents:

If you want to shop for validated clever bills (TransferWise) bills complete files, here we are providing all of the details.

- Wise account-related Email and password.

- Email access associated with Wise account.

- Verified account with photo ID/Driving License

- Virtual Card demonstrated.

- Bank tested.

- Business LLC/ LTD Documents

- Provided Date of Birth.

- USA, UK, CAN, AUS, KHM, COL, DEU other nations Transfer Wise (GEO- Targeted United States of America) Accounts.

Conclusion:

Wise, previously known as TransferWise, offers each non-public and commercial enterprise debt with wonderful features and advantages. The choice between shopping for verified smart debts (business accounts/ Personal debts) relies upon your particular needs. Personal bills are appropriate for people coping with global transactions, while commercial enterprise debts cater to the monetary necessities of organizations engaged in international enterprise sports.

Wise stands out due to several benefits, which include low-value worldwide transfers, transparent costs, actual change costs, a borderline account for containing more than one currency, and fast transaction processing. The platform presents a multi-forex debit card (Wise Card) and gives business-pleasant functions like multi-consumer getting admission to and integration with the accounting software program.

FAQ:

Can I purchase tested-wise non-public money owed with documents?

Yes, we’re offering smart non-public accounts with ID/passport, selfie, e-mail get entry, telephone get entry, and other essential details.

Can I buy proven Business bills with documents?

Yes, we’re presenting smart enterprise debts with LLC/LTD files, ID/passport, selfie (account holder), electronic mail entry, smartphone access, and other vital details.

What use of a-clever bills are available?

We are presenting • USA, UK, CANADA, AUS, KHM, COL, DEU, ASIAN, and other nations, so, buy established clever money owed with less costly prices from us.

What’s the buying manner?

- Simply Choose an Option Add to Cart.

- Proceed to Checkout.

- Send Payment

- After payment, our crew will verify in your email. And should provide me with your WhatsApp variety. Or touch us on telegram/skype.

Can I do unlimited transactions?

While Wise (formerly TransferWise) permits users to make worldwide transactions, there may be limits imposed on the amount and frequency of transactions. These limits can vary depending on elements which include your account type (personal or enterprise) and your verification stage. Here are a few factors to remember:

- Transaction Limits:

Wise might also have day-by-day, weekly, or monthly transaction limits for each non-public and enterprise bill. These limits are often in place to comply with regulatory necessities and to ensure the security of financial transactions.

- Verification Level:

The stage of verification you’ve finished for your Wise account can affect your transaction limits. Completing extra verification steps, such as imparting extra specified identification facts, may additionally result in better transaction limits.

- Business Accounts:

Business money owed might also have special transaction limits as compared to personal accounts, and those limits might be prompted with the aid of the character and length of the enterprise.

- Large Transactions:

For very huge transactions, extra documentation or conversation with Wise may be required. This is to ensure compliance with anti-money laundering (AML) and different regulatory measures.

- Currency Restrictions:

Some currencies or forex corridors may additionally have specific restrictions or limitations due to regulatory or marketplace conditions.

To get unique facts about the transaction limits to your account, it’s far recommended to test the terms and situations on the reputable Wise internet site or touch Wise customer support at once. They can provide info primarily based on your account kind, verification degree, and different relevant elements.

It’s vital to notice that the usage of monetary services inside the bounds of the desired limits and adhering to the phrases of the carrier helps keep the safety and integrity of the platform.

100% Customer Satisfaction Guaranteed.

100% Customer Satisfaction Guaranteed.

account is very good quality and I am using it without any problem. So thank you.

Its amazing services

Old Service figure amazing

Really Amazing services. I Highly Recommend